Free Online Value Added Tax (VAT) Courses and Certifications 2024

Value Added Tax (VAT) is a type of consumption tax that is placed on a product whenever value is added at a stage of production and at the point of retail sale. The amount of VAT that the user pays is on the cost of the product, less any of the costs of materials used in the product that have already been taxed.

Popular Courses

Escribir Academy offers a comprehensive course on Value Added Tax (VAT) for F6 - TX (UK). the experienced faculty will guide you through the fundamentals of VAT and help you understand the complexities of the subject. Get the best learning experience with the interactive lectures and comprehensive course material. Register now and get started on your journey to success!

Learn MoreThis course provides an introduction to Value Added Tax (VAT) and its implications for businesses. It covers the basics of VAT, including the different rates, exemptions, and how to register for it. It also explains the different types of VAT returns and how to complete them. This course is ideal for business owners and entrepreneurs who want to understand the basics of VAT and how it affects their business.

Learn MoreThis course provides guidance and clarity on the VAT treatment of supplies made by municipalities that are registered as VAT vendors. With the course, participants will gain an understanding of the definitions and concepts, agent vs. principal, types of supplies, input tax, adjustments, and miscellaneous matters. The course is based on South African Tax and is presented by Ruzel van Jaarsveld, a seasoned facilitator with over 23 years of financial and bookkeeping experience. Upon completion, participants will receive a certificate of training and 9 verifiable CPD points.

Learn MoreThis course presented by ex-big 4 Accountancy trained VAT experts from the UK, with over 10 years of experience in the UAE, will equip you with a sound understanding of how VAT works and its application in the UAE. Learn the specific rules for the UAE, governed by the FTA, and how it interacts with other GCC states. All businesses are impacted by VAT, with the majority obliged to register. Understand the responsibilities of the business and how it affects their business model, from existing contracts, pricing, sales and marketing, and overhead costs. The compliance obligations are also highlighted. Get in contact with VatCentric Ltd for bespoke services. Don't miss out on this opportunity to gain a comprehensive understanding of VAT in the UAE.

Learn MoreThis course on Value Added Tax (VAT) - Implementation in Saudi Arabia & Gulf is designed to help tax accountants and stakeholders understand the concepts and operations of VAT. With the implementation of VAT in the Gulf, accountants and administrators must be prepared to respond to the challenge. This course provides guidance on VAT accounting and helps participants lead their organization through the process, as well as train their team to get the best output and achieve organizational goals.

Learn MoreThis course provides an in-depth look at the Value Added Tax (VAT) Law of the United Arab Emirates. It covers the basics of the UAE VAT Law, the registration process, the calculation of the registration threshold, the date of supply, the place of supply, various categories of supplies, the detail calculation of the VAT return, and the steps to complete and submit the VAT return using the E-services portal of the Federal Tax Authority (FTA). With successful completion of this course, you will be better equipped to work in a multitasking environment and save on consulting costs for the basics of VAT return filing in the UAE.

Learn MoreThis course on Value Added Tax (VAT) in Oman, KSA, UAE and Bahrain will help you understand the basics and techniques of VAT. It will give you the knowledge to stand out from others in your organization and get you ready for the next level. With practical examples, you will learn the VAT mechanism, terms, operations and accounting. You will be able to apply the specific VAT laws and regulations to any organization or business. Don't miss out on this opportunity to gain a valuable skill and give your career a boost.

Learn MoreThis course provides an in-depth look into Value Added Tax (VAT) laws and applications in the United Arab Emirates (UAE). Learn the fundamentals of VAT, including levy of tax, rate and responsibility of tax, tax groups, supply, imports, types of supply, designated zones, recoverable input tax, capital asset scheme, specific disallowance, tax invoice and more. Gain practical knowledge to tackle real-life challenges related to VAT laws. Get the confidence to apply VAT laws in UAE and wherever you come across it. Enroll now and make VAT easy!

Learn MoreThis course, presented by an ex-PwC/Deloitte VAT consultant from the UK with over 10 years of experience, provides a comprehensive overview of Bahrain VAT. Learn how VAT works and its application in Bahrain, including specific rules governed by the NBT and its interaction with other GCC states. Understand the responsibilities of businesses and how VAT affects their business model, from existing contracts to pricing, sales and marketing, and overhead costs. Also, gain insight into the compliance obligations for businesses. Suitable for those with little or no VAT knowledge, the course covers everything from the basics to advanced material for keen VAT practitioners. Don't miss out on this thorough and comprehensive course - the best you'll find in the market and online.

Learn MoreThis course provides an in-depth look at the Value Added Tax (VAT) law in the United Arab Emirates. It covers the 5% standard rate, registration requirements, place of supply, date of supply, valuation, input tax, capital asset scheme, import and taxability under reverse charge, exempt and zero-rated supply, export, impact on designated zones, records, VAT returns and payment of VAT, offences and penalties. With this course, you will gain a comprehensive understanding of the UAE VAT law and how it affects businesses and consumers.

Learn MoreThis course on Value Added Tax (VAT) in South Africa is designed to help everyday users understand the rules governing the deductibility of input tax and when input tax must be claimed. After completion of this course, you will have a working knowledge of the various Input Tax deductions, understand the concept and application of non-deductible expenses, understand the different documentary requirements for Input Tax, understand the application of specific transactions, and be able to complete the Input Tax section of the South African VAT return. Make a change and learn fast with this course! Start small and think big with VAT: Input Tax for Everyday Users (South Africa).

Learn MoreThis informative session will provide you with the knowledge to claim all the VAT on allowable expenses in your organization. Learn about the expenses you can claim for VAT purposes, such as entertainment, business travel, accommodation, fringe benefits, staff expenses, insurance indemnity, management fees, and more. With practical day-to-day examples, a complete VAT reconciliation will be demonstrated and the subsequent completion of the VAT201 return. Join the course and be guided by Ruzel van Jaarsveld, a seasoned facilitator with 23 years of financial and bookkeeping experience. Receive a recording of the session, Q&A with the presenter, downloadable course material, and a certificate of training. SAIT accredited with 3 verifiable CPD points.

Learn MoreThis VAT Fundamentals & Foundations self-study course is designed to help individuals, staff and financial management understand and calculate VAT returns for a business. It covers topics such as registrations, voluntary and compulsory registrations, sale of a going concern, supplies, VAT categories, 10-day rule, invoices, and more. The course is presented by Ruzel van Jaarsveld, a seasoned facilitator with 23 years of financial and bookkeeping experience. It is SAIT accredited and provides 4 verifiable CPD points. Enrol now to gain insight into the foundations of the VAT system and learn how to manage VAT returns.

Learn MoreThis course provides an opportunity to practice important questions of UAE Value Added Tax (VAT). With explanations of the answers, this practice test is designed to help improve knowledge of UAE VAT in a short time. It is prepared under the guidance of a practicing chartered accountant in UAE and is useful for various examinations. The course includes multiple choice questions on topics such as Introduction of VAT, Registrations, Tax Groups, Taxable supplies, Zero Rated and Exempted supplies, Place of Supply, Date of Supply, Import of Goods and VAT recovery, Return and Payments, Tax Invoices and Record keeping. Feedback and suggestions are welcome for the improvement of the course. Join now and gain the knowledge you need to succeed in your future.

Learn MoreThis course, UAE VAT Tax Mastery: The Ultimate Multiple Choice Challenge, is designed to help you practice important questions of UAE Value Added Tax (VAT). With explanations of the answers, this course is perfect for those looking to improve their knowledge of UAE VAT in a short period of time. It is also useful for those taking exams such as accountants and tax consultants. With regular updates and feedback from the team, you can be sure to get the most out of this course. Don't miss out on this opportunity to gain a better understanding of UAE VAT - enroll now and get the best of luck for your future!

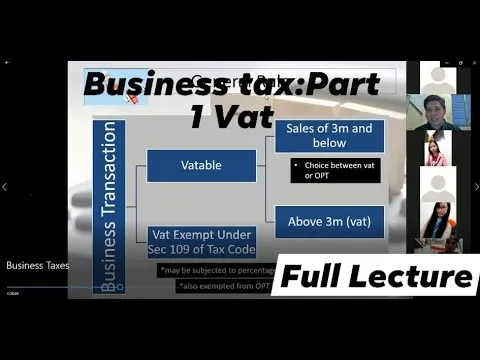

Learn MoreLearn the basics of (VAT) Value Added Tax - Whiteboard Animation Explanation

Learn More Frequently Asked Questions and Answers

Q1: Who pays VAT tax?

In principle, VAT is applicable to all provisions of goods and services. The assessment and collection of VAT are based on the value of goods or services provided during each transaction (sale/purchase). The buyer is charged VAT by the seller, who subsequently pays this VAT to the government.

Q2: What is value added tax VAT examples?

In the case of a product priced at $100 with a 15% VAT, the consumer is required to pay $115 to the merchant. The merchant retains $100 from the transaction while remitting $15 to the government. The utilization of the VAT system extends to 174 countries, predominantly observed in European nations.

Q3: Is VAT deductible on US tax return?

In most cases, only foreign income taxes are eligible for the foreign tax credit. Taxes like foreign value-added taxes, sales taxes, and property taxes are usually not qualified for a credit, but they may be eligible for an itemized deduction.

Q4: Do US customers pay VAT tax?

While VAT is a popular form of indirect taxation in over 170 countries, it is not implemented in the United States. The country lacks a federal tax system and instead relies on a sales tax system administered by the states. This approach to raising revenue differs from that of many other countries.

Q5: What Value Added Tax (VAT) courses can I find on AZ Class?

On this page, we have collected free or certified 25 Value Added Tax (VAT) online courses from various platforms. The list currently only displays up to 50 items. If you have other needs, please contact us.

Q6: Can I learn Value Added Tax (VAT) for free?

Yes, If you don’t know Value Added Tax (VAT), we recommend that you try free online courses, some of which offer certification (please refer to the latest list on the webpage as the standard). Wish you a good online learning experience!