Free Online Swing Trading Courses and Certifications 2024

Swing trading is a style of trading that attempts to capture gains in a stock (or any other financial instrument) over a period of a few days to several weeks. Swing traders use technical analysis to identify stocks that are showing signs of short-term momentum and then hold the position until the momentum reverses. Please bookmark and follow AZ Class. This course list can greatly reduce your time consumption. We have prepared the best Swing Trading course list for you! The latest and most popular online courses, don't miss it!

Popular Courses

Swing Trading Courses

What Are the Best Swing Trading Certifications?

There are many online courses and certifications that can help you learn how to swing trade in the stock market and other financial markets. Swing trading is a style of trading that involves holding positions for a few days to a few weeks, taking advantage of short-term price movements. Here are some of the best ones I found:

**Stock Trading Strategies: Technical Analysis MasterClass 2 by Jyoti Bansal (Udemy)**: This is a comprehensive course that teaches you how to use technical analysis tools and indicators to identify trading opportunities and execute profitable trades. You will learn how to use trend lines, support and resistance levels, chart patterns, candlestick patterns, Fibonacci retracements, moving averages, oscillators, and more. You will also learn how to apply risk management and money management techniques to protect your capital and maximize your returns.

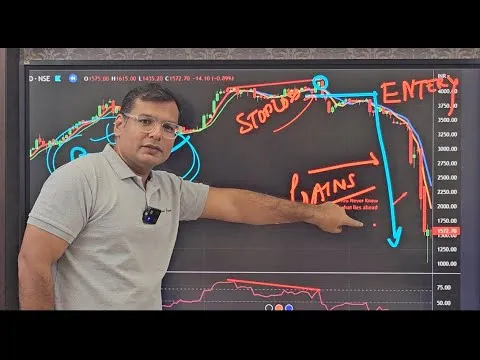

**Swing Trading Ninja: 12 Hour Complete Swing Trading Strategy by Saad T. Hameed (Udemy)**: This is another course that covers swing trading in depth and shows you how to use a proven swing trading strategy that works in any market condition. You will learn how to scan the market for high-probability setups, enter and exit trades with optimal timing, manage your trades with stop loss and trailing stop orders, and analyze your performance with trading journals and metrics. You will also learn how to trade different asset classes, such as stocks, forex, commodities, and cryptocurrencies.

**Swing Trading Course by Bullish Bears**: This is an on-demand course that includes video tutorials to master swing trading, scanning, and strategies. The course is designed to teach you the skills how to become an independent swing trader. You will learn how to read charts, use indicators, draw trend lines, use multiple time frames, identify trends and momentum, and apply various swing trading strategies. You will also get access to practice exercises, expert support, and a certificate of completion.

**Swing Trading Specialization by Indian School of Business (Coursera)**: This is a specialization that consists of four courses that teach you the fundamentals of swing trading in the Indian stock market. You will learn how to use technical analysis tools, such as moving averages, MACD, RSI, Bollinger Bands, and more. You will also learn how to use fundamental analysis tools, such as financial ratios, earnings reports, news events, and more. You will also learn how to develop a trading plan, manage your risk and emotions, and evaluate your performance.

**Forex Trading Price Action: Advanced Swing Trading Strategy by Federico Sellitti (Udemy)**: This is a course that focuses on swing trading in the forex market using price action techniques. You will learn how to read price action on naked charts, without relying on indicators or signals. You will also learn how to use supply and demand zones, trend lines, channels, breakouts, pullbacks, candlestick patterns, and more. You will also learn how to apply risk management and money management rules to optimize your trades.

Frequently Asked Questions and Answers

Q1: What is the difference between day trading and swing trading?

The difference between day trading and swing trading lies in the duration of holding positions. The day trading style involves closing positions before the end of each trading day. Day traders engage in buying and selling multiple assets within the trading day to capitalize on minor market fluctuations.

Q2: What is a swing trader?

A swing trader focuses on capturing the price movements between major lows and highs. During an uptrend, traders seek to buy or 'go long' from these lows and close the trade at the swing highs. Conversely, in a downtrend, traders aim to sell or 'go short' from the highs to the lows.

Q3: How long does a swing trade last?

Swing trading typically entails maintaining a trading position, either long or short, for a duration exceeding one trading session but typically not extending beyond several weeks or a couple of months. While this represents a general time frame, it's important to note that in some cases, trades may extend beyond a couple of months, and traders might still categorize them as swing trades.

Q4: How profitable is swing trading?

When done correctly using sound trading rules, swing trading has the potential to generate significant gains. The objective in a swing trade is to aim for a profit of 5-10%. However, these gains can accumulate rapidly when reinvesting the profits into new stocks and expanding the overall size of the portfolio.

Q5: Is swing trading for beginners?

As mentioned previously, swing trading is considered a favorable trading form for beginners and individuals with limited time. The majority of swing trading strategies involve exiting a trade at the opening of trading days, eliminating the need to remain constantly attentive to a computer screen throughout the day.

Q6: What Swing Trading courses can I find on AZ Class?

On this page, we have collected free or certified 55 Swing Trading online courses from various platforms. The list currently only displays up to 50 items. If you have other needs, please contact us.

Q7: Can I learn Swing Trading for free?

Yes, If you don’t know Swing Trading, we recommend that you try free online courses, some of which offer certification (please refer to the latest list on the webpage as the standard). Wish you a good online learning experience!

ADVERTISEMENT